Precious Metals

Petra lowers price projections, starts retrenchment process

It has appointed Vivek Gadodia chief restructuring officer to lead this work.

"Refinancing discussions have been deferred to 2025 to enable these cash generation initiatives to take effect and to benefit from greater certainty in respect of market conditions. We remain confident of a successful refinancing of the 2026 2L Notes and a further update will be provided at the time of our interim results in February,” says CEO Richard Duffy.

Petra's third sales cycle of the year yielded $71-million from the sale of 700 803 ct, taking full-year sales revenues to $146-million from the sale of 1.3-million carats.

"Like-for-like prices reduced by 7% from the previous tender cycle held in October, reflecting a continued weak market across most size ranges, although we were encouraged by the 3% increase in the 5 ct to 10.8 ct category.

"As a result of the prevailing market weakness, we have revised our price assumptions for the 2025 financial year. Despite the market backdrop, we are encouraged by the majors’ ongoing discipline around restricting the volume of rough diamonds to support the market and initiatives by upstream, midstream and retail sectors to collaborate in the category marketing of diamonds," says Duffy.

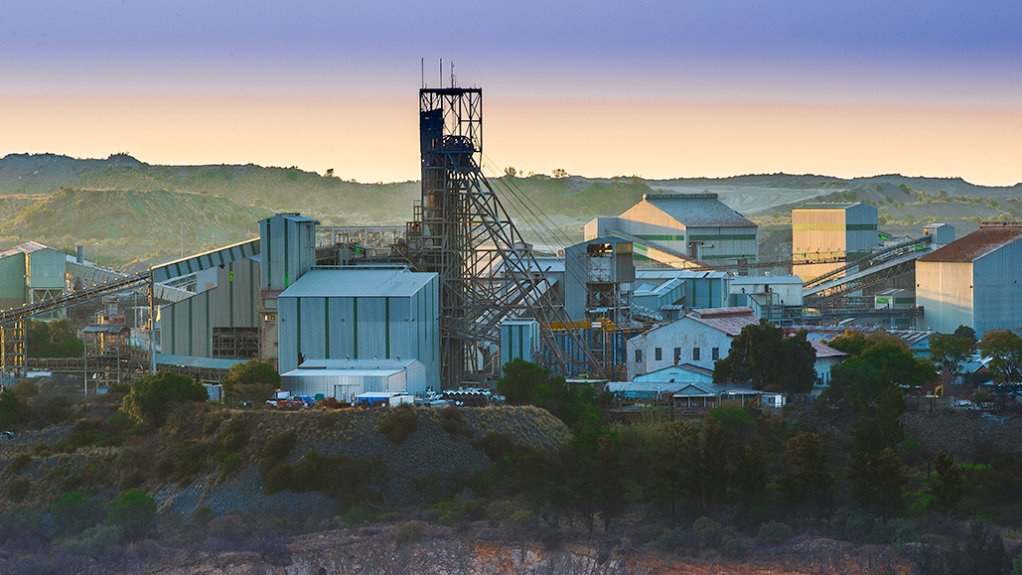

The group initially expected diamonds from the Cullinan mine, in South Africa, to be between $125/ct and $135/ct, but has lowered its forecast to $120/ct to $130/ct.

The price projections for the Finsch mine, also in South Africa, has been lowered to between $80/ct and $90/ct, compared with previous estimates of $98/ct to $105/ct.

Diamonds from the Williamson mine, in Tanzania, are now expected to attract prices of between $170/ct and $200/ct, compared with previous estimates of $200/ct to $225/ct.